Independent Claims Adjusting Services in Jacksonville, Florida

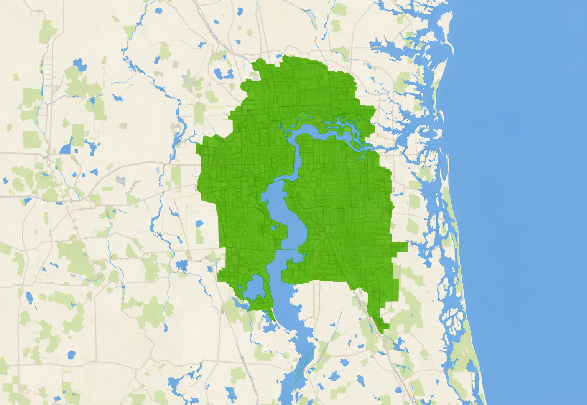

Jacksonville is the largest city by land area in the continental United States and a major economic center in Northeast Florida.

With a busy port, military presence, and a growing population, it plays a critical role in Florida’s commercial and insurance landscape.

The city is home to one of the largest deepwater ports on the East Coast, a strong logistics and transportation sector, and major employers in healthcare, finance, and defense.

Jacksonville is more than a business hub.

With miles of Atlantic coastline, the St Johns River running through the city, and year round sunshine, it offers a unique mix of urban infrastructure and coastal living.

Churchill Claims is a nationwide independent adjusting organization.

We provide adjusting services in every US state with more than 20 years of experience working throughout Florida, including the entire Jacksonville area.

What do Examiners and Claims Supervisors want?

They do not want to feel disappointed or frustrated by an adjuster.

They want to know they have someone they can trust to handle the insurance claim correctly from start to finish.

They value anything that helps the claims office run more smoothly.

Clear and consistent communication with no surprises.

Adjusters who think ahead instead of reacting once problems arise.

Fast and accurate reporting that reduces follow up work.

Professionals who represent the carrier well when dealing with policyholders.

Reliability means someone they never have to chase.

Solutions instead of excuses.

Adjusters who make their day easier, not harder.

Why Hire an Independent Claims Adjuster in Jacksonville, FL?

If you need a dependable adjuster, a second opinion, or a thorough investigation that uncovers every relevant fact, Churchill Claims delivers precise, impartial, on time, and court ready assessments.

Your independent claims adjuster company in Jacksonville, Florida

We maintain a fully prepared team of investigators, supervisors, and adjusters who can be deployed anywhere in Jacksonville and the surrounding areas at any time.

With more than two decades of experience, proven investigative procedures, and a proprietary high tech claims management system, we deliver accurate, timely, and consistent reports on every assignment.

Our adjusting company offers the following services:

Why Choose Churchill Claims Services for your Jacksonville Claims?

We work exclusively with experienced, background checked, and tested adjusters.

We are accredited, certified, and recognized by respected industry organizations, including:

- Cado

- Claimspages

- Nationwide Services = 5 star, “frustration free”

- National Association Independent Insurance Adjusters

- AM Best Client Reccomended Adjusters 2025

- BLP Bar List Publishing

- The Duke Of Edinburgh Awards

We investigate every claim fully, on time, and to the highest standard.

Our team uses organized tracking systems, detailed reporting tools, dedicated supervisors, and professional proofreaders to ensure accuracy.

We are already the preffered service provider for

- Scottsdale Insurance Company

- Hanover Insurance

- Burns-Wilcox Insurance

- Monticello Insurance

- Atain Insurance Companies

- Ohio Mutual Insurance Group

- K&K Insurance

- Mutual of Enumclaw

- U.S. Liability Insurance

- Travelers Insurance

- Great American Insurance

- AmTrust Group

- Vanliner Insurance

- Clarendon National

- Northland Insurance

- Knight Transportation

- MMG Insurance

- ArcBest

Our Adjusting Process for Jacksonville Insurance Claims

The adjusting process is the complete workflow an adjuster follows from the moment an assignment is received until the final report is delivered. While details vary by claim type such as auto, property, liability, cargo, or SIU, the core process remains consistent across the industry.

Below is the full standardized process:

-Assignment Received

The claim is formally submitted to our adjusting firm. The assignment typically includes claimant or insured contact information, date of loss, incident details, required tasks, policy information when applicable, and any special instructions or carrier guidelines. The assignment is logged and the file officially opens.

-Initial Acknowledgment within 24 hours

We notify the examiner that the claim has been received, confirm the assigned adjuster, and provide a clear timeline for first contact.

-First Contact within 24 to 48 hours

The adjuster contacts all relevant parties including the insured, claimant, witnesses, attorneys when applicable, and law enforcement or agencies if needed. The goal is to introduce themselves, confirm claim facts, schedule inspections or interviews, and clarify any missing information. Prompt and professional contact sets expectations and helps prevent policyholder complaints.

-Insurance Claim Investigation Phase

This is the core of the adjuster’s work. Depending on the claim, the investigation may include interviews and recorded or written statements, witness and third party interviews, vehicle and property inspections, and scene inspections such as slip and fall, liability, trucking, cargo, or fire losses. When appropriate, drone or 3D capture is used for property or catastrophe claims.

Evidence and documentation may include photographs and video, police reports, medical reports, repair estimates, diagrams, measurements, receipts, invoices, proof of ownership, and weather reports for storm related losses.

While independent adjusters do not make coverage decisions, they gather the facts needed to support them, including policy conditions, exclusions, limits, and deductibles.

Throughout the investigation, the examiner is kept informed through status reports, emails, and calls for urgent findings.

-Reporting from preliminary to final

High quality adjusting firms provide multiple structured reports.

The preliminary report is sent early and includes contacts made, inspection dates, initial findings, and any immediate concerns.

Status reports are sent during longer investigations and outline progress, outstanding items, any delays, and next steps.

The final report is delivered once the investigation is complete and includes a clear chronological summary, findings of fact, photos, evidence, diagrams, statements, damage estimates when applicable, and the adjuster’s conclusions and recommendations based on carrier guidelines.

Churchill Claims adds multiple layers of review including supervisor review, technical review, professional proofreading, and final sign off to ensure reports are complete and frustration free.

–File Closure

After the final report is submitted, the adjuster confirms the examiner has all required data, completes CMS updates, ensures follow ups are closed, and formally closes the file. Some claims may be reopened years later due to litigation or new evidence, and we remain available if that occurs.

-Reopenings when needed

Claims may reopen due to legal disputes, supplemental damages, new evidence, or re inspections requested by carriers. When this happens, the adjuster continues the investigation as instructed.

Frequently Asked Questions

What makes Churchill Claims Services different from other independent adjusting firms in Jacksonville?

We have the tools, systems, procedures, and experienced staff needed to deliver extremely accurate reports in very short timeframes.

Our support team is available during business hours for immediate communication including calls, messages, and coordination.

No we will get back to you later.

No excuses.

No unfinished reports.

We deliver complete and professional results every time.

Are Churchill Claims Services adjusters licensed to operate throughout the state of Florida and Jacksonville?

Yes. We are fully licensed and authorized to operate in all states, including Florida.

Does Churchill Claims Services work with national insurance carriers as well as local companies?

Both. We also assist organizations that issue coverage but are not traditional insurance companies.

How long does an insurance claim usually take when handled by Churchill Claims Services in Florida?

Timelines depend on claim type and complexity, but our turnaround in Jacksonville is well below the industry average.

If you need a specific estimate, contact us and we will provide a clear and realistic timeline.

Got a question or an assignment? Get in touch!

If you have insurance claims that you’d like us to take care of or if you have questions regarding our services, use the button below to send us a message.